The current international political and economic environment is in a period of intense adjustment. There are both geopolitical factors and the repositioning of the value chain system in the process of global division of labor. As a big country that is in the process of continuous development and wants to achieve national rejuvenation, it is an inevitable trend to continue to extend upstream of the industrial chain so that its citizens can live a better life. In this process, it will inevitably break the existing market structure and encounter certain resistance. Just imagine, who would give up the market to others? But based on the principle of market competition, it is stronger than other more intense means of confrontation.

Bozhon Seiko Research Institute believes that fierce confrontation is detrimental to both China and the United States. China has always adopted the approach of peaceful rise and equal competition, but how to achieve healthy competition in the semiconductor industry through innovation of its own value, symbiosis and common prosperity - not just one company Monopoly dominance may be the theme of China and the United States in the semiconductor industry for a long time to come. From the perspective of business competition, we should adhere to the idea of "making the cake bigger together" instead of "just cutting the existing cake". Competition can promote the common improvement of both parties, thereby cultivating more diversified and efficient technical routes and achieving greater success. application market, this has been verified in fields such as communications and aviation. In the future, China and the United States will keep pace with each other in the semiconductor industry, which may be more conducive to improving the level of intelligence and digitalization in the new round of industrial revolution.

![]()

For China, just like new energy vehicles, is it possible to break out of the current predicament and achieve new transcendence on the technical route?

Economist List mentioned the saying of "kicking away the ladder" in "The National Economic System of Political Economy", which means that "when a person reaches a peak, he will kick away the ladder behind him to prevent others from doing so." Follow up to ensure your advantage." The chip & semiconductor industry originated in the United States. If the United States wants to maintain its advantages, it must constantly kick up the ladder.

In the 1980s, through the "DRAM Manufacturing Method Innovation" project, Japan completely surpassed the United States and became the dominant player in the semiconductor industry. By 1985, the American SIA believed that if the government did not take severe measures quickly, the entire industry would perish in competition with Japan. The United States officially launched the "First Chip War." Through this war, in 1992, the United States mainland The company regained market share and reached 20% share in Japan. In 1993, the United States once again became the world's largest chip exporter. During this period, South Korea and Taiwan also rose with the support of the United States, and the world entered a situation in which one country was dominant and multiple powers coexisted. Up to now, although Japan is still an important player in the chip industry, its global share is only 6%.

With Japan's lessons learned, the United States took the initiative to start a new round of "chip war" before China became bigger. The United States has imposed a series of sanctions on Chinese technology companies and individuals since 2018. In March 2022, it proposed to create a "Four-Party Chip Alliance", and then in August it passed the "Chip Act", which plans to provide the U.S. semiconductor industry with Up to $52.7 billion in government subsidies. Among them, US$50 billion has been allocated to the "American Chip Fund" plan. The remaining US$2.7 billion is the US$2 billion U.S. Chip Defense Fund, the US$500 million Chip International Technology Security and Innovation Fund, and the US$200 million Chip Labor and Education Fund. According to information released by the U.S. Department of Commerce, the "American Chip Fund" program aims to revitalize the U.S. domestic semiconductor industry and stimulate innovation while creating high-paying jobs across the United States.

The implementation strategy released by the U.S. Department of Commerce on the 6th shows that of the above-mentioned US$50 billion, approximately US$28 billion will be used to fund the establishment of manufacturing and packaging facilities for advanced process chips, and approximately US$10 billion will be used to expand the manufacturing and packaging facilities used in automobiles and other fields. Mature process chip manufacturing, another approximately US$11 billion is planned to be invested in research and development in the semiconductor field. It is generally believed that processes of 28 nanometers and below are advanced processes. The New York Times quoted Raimondo on the 6th as saying that the U.S. Department of Commerce aims to start collecting funding applications from relevant companies before February next year, and may start disbursing funds next spring. Raimondo said applicants must provide evidence "in the form of capital investment financial disclosures" that the funds sought are "absolutely necessary" to make the investment, Hong Kong's South China Morning Post reported.

It is worth noting that the "Chip Act" contains "guardrail provisions", which means that companies receiving funding cannot make new high-tech investments in China or other "countries of concern" for at least 10 years unless they produce technology Mature process chips with lower content only serve the local market.

U.S. Commerce Secretary Raimondo previously emphasized at a White House press conference that if funded companies and institutions fail to fulfill certain commitments, the Department of Commerce will "not hesitate to withdraw funds."

Since the core purpose of the U.S. Chip Act is to boost the U.S. chip industry, especially the chip manufacturing industry, the U.S. chip manufacturing plants, such as Intel and GlobalFoundries, will benefit the most after the policy is introduced. Daiwa Capital Securities noted that of the $39 billion in fab subsidies, Intel is expected to receive 32%, Micron 31%, Texas Instruments 14%, Samsung 13% and TSMC about 10%. Affected by the bill, leading U.S. chip companies have also taken action.

Intel is one of the most aggressive companies, and its CEO Kissinger is an active promoter of the U.S. chip bill. He has repeatedly urged the U.S. Congress to pass the chip bill as soon as possible in public. After the bill was enacted, Intel's wafer fab in Ohio was restarted, and the plan is still 20 billion US dollars. Judging from this scale, it will be the largest wafer fab in the world. Currently, Intel is still working on 7nm, two generations behind TSMC. According to reports, Intel's new wafer fab will be able to mass-produce 20A and 18A two-generation processes when it is put into production in 2025. The 20A process corresponds to TSMC and Samsung's 2nm, while 18A corresponds to TSMC and Samsung's 1.8nm, which is the 18 angstrom process. In other words, Intel plans to directly mass-produce 2nm chips in 2025, catching up with TSMC and Samsung, because TSMC and Samsung also plan to mass-produce 2nm chips in 2025.

Secondly, IDM companies like Micron will also become the second category of beneficiaries of the chip bill. Recently, Micron announced a US$40 billion investment plan to promote domestic memory chip manufacturing in the United States.

Finally, U.S. equipment companies related to chip manufacturing are the third-tier beneficiary group of the bill. These companies are the mainstay of the improvement of U.S. chip manufacturing capabilities. As U.S. chip manufacturing capabilities improve, U.S. semiconductor equipment will usher in a new wave of development.

For the U.S. government, it is easier to achieve economies of scale by supporting leading companies and accelerate the U.S.'s dream of "American Core." At the same time, the U.S. government also acts as a glue between U.S. chip manufacturers and design manufacturers. Before Biden officially signed the chip, Qualcomm and GlobalFoundries announced that they would spend $4.2 billion to expand a chip factory in upstate New York. It can also be seen from Qualcomm's order to GlobalFoundries that the chip bill may push wafer foundries to slowly shift to American manufacturing, mainly American wafer foundries.

By October 8, the United States announced a series of new export control measures, including a ban on providing China with certain chips produced around the world using American equipment. The "chip war" launched by the United States against China is intensifying.

The investment and construction of factories by chip companies will undoubtedly bring vitality to the U.S. chip industry. However, once the factory is built, it will face a major problem, that is, the United States lacks enough chip professionals.

A previous report by the American Semiconductor Association and the Oxford Research Institute pointed out that compared with the general technology industry, the semiconductor industry's economic boost multiplier is about 6.7, while the median of other statistical industries is about 3.7. Equivalently, every worker hired in the semiconductor industry will indirectly support 7 jobs. In other words, the US chip bill has created a large number of jobs in the United States.

However, over the years, as the U.S. chip manufacturing industry has continued to decline and move overseas, the chip industry is no longer an industry with high wages and high reputation. Therefore, when choosing a major, outstanding American talents will choose finance, marketing and other majors instead of electronic information engineering, mechanical design automation, materials and other chip-related majors. The chip industry is an industrial chain. The United States not only lacks chip-related professionals, but also lacks talents in the upstream and downstream factory construction, instrument and consumable manufacturing, logistics, storage and transportation related fields of chip production.

This problem cannot be solved by U.S. government subsidies. No matter how strong the U.S. government's preferential treatment and subsidies are, it will still be difficult to recruit suitable employees in the United States. Without a workforce that meets the requirements, chip companies are naturally unwilling to invest in setting up factories in the United States. Under repeated pressure from the United States, TSMC and Samsung were forced to set up factories in the United States. The biggest problem they encounter now is that once the factories are built, where will the employees come from? TSMC Chairman Liu Deyin publicly stated in June that it is difficult to recruit engineers and technicians in the United States. After Biden signed the "CHIP Act", the White House issued a press release saying that the bill would create a large number of job opportunities in the United States. In fact, job opportunities have been created, but how many labor forces are there in the United States to match these opportunities?

Even if it is difficult to recruit professional employees, the professionalism of many people will not meet the requirements of the chip industry. An article once appeared on an American employee evaluation website. The author was a new employee that TSMC had finally recruited in the United States. After participating in new employee training, he discovered that TSMC employees work at least 10 hours a day, including night shifts, weekend shifts, and being on call at other times. Colleagues told him that this is the daily working status of the chip industry. The American complained that he did not expect to work so hard and with such intensity.

In China's semiconductor revitalization policies in recent years, three keywords have appeared frequently: linked development of the industrial chain, introduction and cultivation of enterprises, and construction of public service platforms. This also reflects the increasingly obvious trend of fragmentation and confrontation in the global chip industry under political influence. Local governments no longer only focus on support and catching up in a certain link, but also focus on the joint development and supporting construction of upstream and downstream, in order to Improve the localization level of the chip industry chain and ensure its own supply security.

At present, national policies and financial investment have been significantly tilted towards the chip industry. Therefore, there are basically people working on every link in the chip industry chain. In terms of market demand, China is also the country with the largest demand for chips.

Overall, our country has many companies that completely cover the entire chip industry chain. In terms of EDA software at the most upstream of the chip industry, there are Huada Jiutian, Xinhe Semiconductor, Hongxin Micron, Xingxin Technology, Guangli Micro, etc. Among them, Guangli Micro's EDA software covers the entire field of integrated circuit yield improvement. Process, the product has been successfully applied to the current most advanced 3-nanometer process technology node. Guangli Micro's customers include leading wafer fabs such as Samsung Electronics.

In terms of semiconductor materials, there are listed companies such as Zhonghuan Technology, Youyan New Materials, and Xingsen Technology. Among them, Zhonghuan Technology, which ranks first, has successively completed the development of crystal technologies including FZ ultra-high resistance, CZ ultra-low resistance, and CZ ultra-low oxygen. And the development of 8-12-inch EPI, RTP, Ar-Anneal and other wafer processing technologies. The main products include photovoltaic silicon wafers, photovoltaic modules, semiconductor materials, photovoltaic power stations, semiconductor devices, etc.

Thirdly, in terms of semiconductor equipment, China also has the most complete industrial chain layout in the world. From photolithography machines to etching machines, to all kinds of equipment, China basically produces them, such as Northern Huachuang, China Microelectronics Corporation, Tuojing Technology, Shengmei Shanghai and other companies

Finally, there is the chip packaging and testing industry. This industry is the sub-industry with the most outstanding advantages in my country's semiconductor field. In the current domestic semiconductor industry chain, it has the highest degree of localization and the most mature industry development. Several domestic packaging and testing manufacturers, such as Changdian Technology, Huatian Technology, Tongfu Microelectronics and other giants, have already entered the top ten in the world.

Although the chip industry chain is complete and some links are very strong, it is still very weak overall, and the road to local substitution is still long. For example, in terms of EDA software, the overall localization rate is about 10%.

In the core equipment field, the localization rate of glue coating and development equipment is 1%, the localization rate of photolithography equipment is 1.1%, the localization rate of ion implantation equipment is 3.1%, the localization rate of process control is 3.6%, and the localization rate of thin film deposition is 5.7%. The localization rate of etching equipment is 22%, the localization rate of chemical mechanical planarization is 23%, the localization rate of oxidation diffusion/heat treatment equipment is 28%, the localization rate of cleaning equipment is 38%, and the localization rate of degumming equipment is 74%;

The reason why the proportion of localized replacement of chip equipment is so low is that on the one hand, we have not accumulated enough basic chip research, mainly because we started too late and took many detours in the process.

![]()

On the other hand, our country's comprehensive industrial accumulation cannot keep up. For example, we cannot build a top-notch photolithography machine. In fact, in 1980, our country built the first domestic projection lithography machine. In 1985, Institute 45 of the Chinese Academy of Sciences made significant progress in the field of lithography machines and developed a step-by-step projection lithography machine, which was deemed to have reached the level of the lithography machine launched by the American GCA Company in 1978. At that time, the future lithography machine giant ASML had just been born.

However, due to the reform and opening up, a large influx of more advanced foreign lithography machines, coupled with the withdrawal of national funds, has brought the research of domestic lithography machines to a standstill. It was not until 2016 that Shanghai Microelectronics finally achieved mass production of 90nm lithography machines. According to Shanghai Microelectronics, it is expected to deliver the first 28nm process domestic lithography machine in 2022. But even if 28nm domestic lithography machines achieve mass production, they are still several generations away from 7nm and 5nm.

Therefore, the localization of chip equipment, especially the localization of high-end equipment, is still far from meeting demand, and the dependence on foreign equipment is still high.

In the field of materials, the technical barriers to semiconductor material manufacturing are very high. Due to the lack of long-term R&D investment and accumulation by enterprises, my country's semiconductor materials are mostly in the mid- to low-end fields. The supply of semiconductor silicon wafers, wet electronic chemicals, electronic gases, targets, photoresists and other materials is still highly dependent on imports.

In addition, the technology that most of my country's current equipment can support is not the most advanced level. It can mass-produce chips at the highest level of 14nm. Most of the higher-end chips still rely on foreign countries and need to be imported.

These are ultimately due to the fact that the development of domestic equipment manufacturing industry cannot keep up and cannot produce the top equipment necessary for the chip industry. In the mid-1990s, my country formed an industrial system with a complete range of categories, considerable scale and technological level. But today, compared with the international advanced level, my country's equipment manufacturing technology is still 5 to 20 years behind. This lag in development has become a bottleneck that hinders the improvement of the efficiency of the national economy, restricts the development of high technology and its industries, and restricts national defense security.

This mainly lies in:

First, the country does not pay enough attention to it and its strategic mistakes and lags. In the 20 years from 1956 to 1976, my country missed the golden period of development, resulting in my country's equipment manufacturing industry lagging behind advanced countries for a long time;

Second, my country's equipment manufacturing industry generally has a serious excess of low-level processing capacity and production capacity of ordinary mechanical products. Most of the large-scale complete sets of equipment with internationally advanced levels cannot be manufactured, and many major technical equipment still rely on imports;

Third, CNC systems, engines and key components are weak links in the equipment manufacturing industry. The CNC system is the nervous system of the equipment and represents the automation level of the equipment. The backwardness of key components and basic components has become a bottleneck for the development of the equipment manufacturing industry.

Fourth, the ability of independent innovation is weak. There is a lack of interest linkage mechanism between equipment manufacturing enterprises and user enterprises. Except for enterprises with key government support, the rest are in a state of shrinkage, and their independent innovation capabilities are seriously insufficient.

Bozhon Seiko Research Institute believes that in order to truly make China's semiconductor industry rise, policies and investments must be simultaneously tilted towards the equipment manufacturing industry, especially the equipment manufacturing industry involving semiconductor manufacturing, in order to fundamentally solve the problem.

First of all, one thing must be made clear again: China wants to become a manufacturing power and achieve great rejuvenation; while the United States wants to suppress its competitors and maintain its international status and advantages. Confrontation between the two is inevitable. The development of the chip industry is related to all aspects of the country's future technological development and is one of the main areas of competition between the two. Then, it is obvious that semi-chip de-globalization will continue in the future and may even become the norm. The chip industry will shift from a state of supply and demand competition to a state of national science and technology competition.

In terms of silicon-based chips, there is an industry consensus that the domestic chip industry will be in a state of catching up for a long time to come. Then, to achieve true overtaking in corners, we may need to wait for the emergence of disruptive technologies or the switch of industrial development tracks.

Add the application of AI technology to chip design. Some industry experts say that AI technology will bring disruptive changes to the entire chip industry. If AI is applied to a single aspect of chip design, the accumulation of experienced engineers can be integrated into EDA tools, significantly lowering the threshold for chip design. If AI is applied to the entire process of chip design, existing experience can also be used to optimize the design process, significantly shortening the chip design cycle, while improving chip performance and reducing design costs.

Over the past two decades, under Moore's Law, the main direction of chip design has been the continuous shrinkage of transistors and increasing computing power through the inherent architecture of the hardware. As Moore's Law gradually expires and AI technology continues to mature, joint design of software and hardware has become a new chip design trend.

Using EDA tools with AI technology to design chips will definitely shorten the time. The reason why AI can shorten the chip design cycle is not complicated. The main reason is to let AI learn through learning first. With the accumulation of knowledge, it can encounter problems in the subsequent use process. The same or similar problems can be solved faster, so it is almost a certainty that EDA with AI can save the chip design cycle.

There are two forms of AI applied to EDA. Since chip design is a long and complex process, more than a dozen EDA tools may be needed during the entire process. Therefore, AI can be applied to EDA point tools to optimize a single chip design link, or it can Used to optimize the entire chip design process.

Of course, integrating AI and EDA tools can not only significantly save research and development time, but also improve chip performance and reduce design costs. Moreover, in the future, AI technology will most likely be integrated into the entire process from chip architecture design, manufacturing, and packaging.

But what needs attention is: the underlying support of AI applications also needs support from the chip industry. How to solve the conflict between chicken and egg?

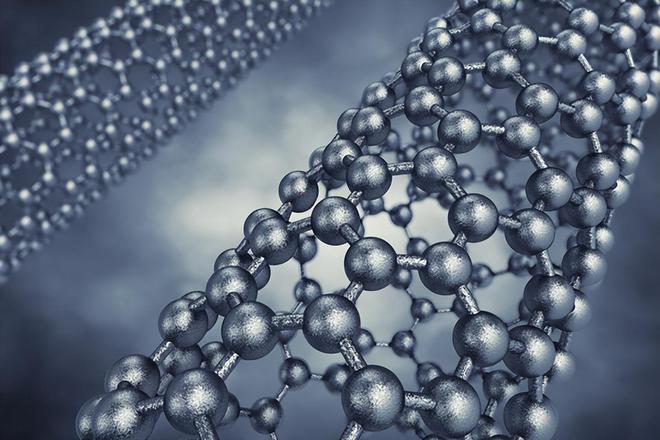

Another way is to change the track, such as laying out the carbon-based chip industry in advance. It has become a consensus in the academic community that the comprehensive performance of carbon-based chips prepared with carbon nanotubes can be hundreds or thousands of times higher than that of silicon-based integrated circuits.

Carbon nanotubes were discovered by Japanese scientist S. Iijima in 1991. Carbon atoms are arranged hexagonally to form a single atomic layer, which is graphene. A rectangular graphene strip, with its long sides butt-jointed and rolled into a roll, becomes a carbon nanotube, generally about one nanometer in diameter. Carbon nanotubes have some unique quantum effects, which make their electronic performance very good, fast and low in power consumption. It can be said that among currently known materials, carbon nanotubes are the best material for making chips.

The team of Peng Liancao, a professor at the School of Electronics at Peking University, has been engaged in the research of domestic carbon-based chips since 2000. Over the past 22 years, he has led the team to develop a complete set of carbon-based chip technology, and for the first time prepared a carbon nanotube transistor with a performance close to the theoretical limit and a gate length of only 5 nanometers, achieving a breakthrough "from 0 to 1" and paving the way for Chinese chips to break through the West. The blockade and opening of the era of independent innovation have opened up a new path.

The first is to break through the material bottleneck and master the carbon nanotube preparation technology. After ten years of technical research, Peng Lianmao's team abandoned the traditional doping process and developed a complete set of doping-free preparation methods for high-performance carbon nanotube transistors.

Carbon nanotube materials are so tiny that they are invisible to the naked eye. It cannot be seen with an optical microscope and can only be seen with an electron microscope. At the same time, it must be manipulated to arrange it in a certain order. Peng Lianmao has done a lot of research on electron microscopy before and has some experience in observing and manipulating "little things". In 2017, the team prepared a carbon nanotube transistor with a gate length of 5 nanometers for the first time. This is the smallest high-performance transistor in the world to date. Its comprehensive indicators of intrinsic performance and power consumption are about 10 times higher than that of the most advanced silicon-based devices. With comprehensive advantages, the performance is close to the theoretical limit determined by the uncertainty principle of quantum mechanics.

In 2018, the team made another important breakthrough and developed an ultra-low-power Dirac source transistor with a new principle, laying the foundation for the development of ultra-low-power nanoelectronics. In the same year, the team used high-performance transistors to prepare small-scale integrated circuits with a maximum speed of 5 gigahertz.

In 2020, the team prepared for the first time the high-purity and high-density carbon nanotube array materials required to achieve large-scale carbon-based integrated circuits, and used this material to first realize a carbon nanotube integrated circuit with performance exceeding that of silicon-based integrated circuits. The frequency exceeds 8 gigahertz, ranking among the international leaders.

Peng Lianmao's team has basically mastered the technology of preparing carbon nanotube integrated circuits. In the laboratory, carbon nanotube materials can be used to prepare some medium-scale or even large-scale integrated circuits, but it is not yet possible to use them to make ultra-large-scale integrated circuits.

To realize ultra-large-scale high-performance integrated circuits, it is first necessary to prepare ultra-high semiconductor purity, aligned, high-density, and large-area uniform single-walled carbon nanotube arrays on a large-area substrate. In addition, what is even more difficult is the need for a dedicated industrial-grade R&D line, which the team does not have. Under the school's existing experimental conditions, the most complex carbon nanotube chips that can be produced have only a few thousand or at most hundreds of thousands of transistors, and the size is still on the micron level; and among the most advanced silicon-based chips in the world, There are 50 billion transistors, and the area of each transistor is only about 100 nanometers.

Dedicated design tools for cutting-edge carbon-based chips are also lacking. At present, there are no insurmountable obstacles in principle for undoped CMOS technology based on carbon nanotubes. However, just completing existence verification and possibility research and demonstration in the laboratory does not mean that carbon-based chip technology can be completed on its own. The technology is implemented and commercially competitive. There is still a lot of work to be done in order to turn the school's technology into an industrialized technology that can be produced on a large scale. At present, there are still many problems that need to be solved in the engineering and industrialization of carbon-based chips, which will take a long time and a lot of investment.

But it is undeniable that the replacement of silicon-based chips by carbon-based chips is a major trend. Peng Liancao said that with the country’s attention and sufficient scientific research funding, it is expected that carbon-based technology will be able to achieve small-scale application in some special fields in 3-5 years. Application; It is expected that in 10 years, carbon-based chips are expected to gradually become mainstream chip technology with product changes.

Carbon-based chips are a new path for the world, and my country is still in a relatively leading position. Therefore, it is very possible to realize the "lane change and overtaking" of China Chip through the development of carbon-based chips.

Secondly, because quantum chips do not require a photolithography machine, they are also considered to be an opportunity to achieve overtaking in corners. In this regard, China has always been at the world's leading level.

For example, the team of Academician Guo Guangcan of the Chinese Academy of Sciences prepared the world's largest three-dimensional integrated optical quantum chip in February 2018, and realized the three-qubit logic gate control of semiconductors for the first time in the world; in June 2021, the team collaborated with Sun Yat-sen University and Zhejiang University University and other research groups collaborated and successfully designed and prepared a "harpoon"-shaped topological beam splitter structure for the first time.

In addition, Hefei Origin Quantum, led by the team of Academician Guo Guangcan, has successively launched the Origin 6-bit superconducting quantum chip "Kuafu KFC6-130" and the 24-bit superconducting quantum chip "Kuafu KFC24-100". Their fidelity and coherence time and other technical standards, all of which are world-class.

In February 2022, the QUANTA team of the School of Computer Science of the National University of Defense Technology jointly developed a new programmable silicon-based optical quantum computing BD6236FM-E2 chip with the Academy of Military Science, Sun Yat-sen University and other domestic and foreign units, realizing quantum algorithms that solve various image problems. Although this new quantum chip also uses micro-nano processing technology, due to different production principles, it mainly integrates a large number of optical quantum devices on one chip. Once the commercialization of optical quantum chips is successful, research on process technologies such as 7nm and 5nm will lose its original significance, and the field of chip manufacturing will reach a new milestone and break through the stuck dilemma of chip manufacturing.

All in all, whether it is a carbon-based chip or a quantum chip, the outside world estimates that its mass production time will be between 3-10 years. To achieve this goal, the supporting industry chain for carbon-based chips and quantum chips must keep up, among which the equipment manufacturing industry plays an important role.

Because as chip materials change, the matching design software, manufacturing processes, production equipment, etc. will definitely be different from silicon-based chips.

At present, both chips are still in the stage of manual processing in the laboratory. To truly achieve mass production of manufacturing equipment, major equipment manufacturing companies will need to spend a lot of resources and time to explore, and it will also require a lot of national policy tilt and social financial support.

But currently in these two fields, China and foreign countries are at the same starting line. Therefore, whether China can solve the bottleneck problem and achieve overtaking in corners; whether foreign countries can continue to restrict China's development in silicon-based chips while continuing to contain carbon-based chips and quantum chips will all depend on the next three years. Within ten years, it will gradually become clearer.

Bozhon Seiko Research Institute believes that equipment manufacturing is the key to the final application of all products. This is also the top priority for the success of switching technology routes. Therefore, China's layout in the semiconductor field should adhere to the line of equal emphasis on R&D, design and equipment manufacturing, in order to achieve a truly independent vertical industrial system and large-scale domestic applications.

Judging from China's successful experience in aerospace, communications, high-speed rail and other fields, the huge domestic application market is an irreplaceable advantage. Coupled with the thousands of highly dedicated Chinese technology R&D and manufacturing engineers who are willing to work day and night, As long as we choose the right direction on the technical roadmap, I believe that China's semiconductor industry may be able to achieve more independent and complete domestic applications in the next 5-10 years and have a place in the international market.

(The authors of this article, Wei Longteng and Ji Zhan, are from Bozhon Seiko Research Institute)